Say hello to

wealth worth reading.

Heller Wealth Management Insights Blog

News & Insights

Forbes Best-In-State Wealth Advisors 2025 List

Forbes Best-In-State Wealth Advisors 2024 List

We are pleased to announce that for the fifth year in a row, Larry has been selected for the Forbes Best-In-State Wealth Advisors 2024 for

Pacer ETFs Ring the Nasdaq Stock Market Closing Bell

Pacer ETFs (Nasdaq: PTNQ), visits the Nasdaq MarketSite in Times Square to commemorate the Pacer US Trendpilot 100’s new listing with Nasdaq. In honor of

Back to Business on 103.9FM

Larry is interviewed by host and former financial advisor David Levenstein on “Back to Business” on 103.9 FM.

Here’s how much cash retirees really need, according to financial advisors

With inflation fears high and interest rates at rock-bottom lows, retirees may wrestle with how much cash they need during their golden years.

Plan for Retirement While You’re Young

I’m 33, have no debt and a net worth of $700,000, with $600,000 of that invested (95% in stocks and 5% in bonds), $50,000 in

Coronavirus: What to Do Now With Your Retirement Account

Coronavirus: So what should you do now With your retirement account as stocks rollercoaster?

Markets and the Economy

Larry Heller, Pres Heller Wealth Mgmt, a Giserman Group client, quoted on WCBS Radio by Joe Connolly

Retired or nearly there? How to weather a market downturn

A bad stock market is unsettling for any investor. For retirees and near-retirees, though, bad markets can be dangerous. Stock market losses early in retirement

Give Till it Hurts to Your 401k

How to plan for the future? Larry Heller provides insights. Listen to the segment on funding your 401k and more.

2020 Retirement Law Changes

Larry Heller, President of Heller Wealth Management, appears on the Jim Bohannon Radio Show. Listen to the segment on 2020 Retirement Law Changes.

Millennials Hooked on Renting

Larry Heller, President of Heller Wealth Management, appears on the Jim Bohannon Radio Show. Listen to the segment on 2020 Retirement Law Changes.

I Want to Retire Early. Where Should I Invest?

I want to retire at age 55. I contribute to several retirement savings plans but worry I’ll be penalized for withdrawing my savings early. I

Should You Play The Bond Rally?

The recent bond market rally has left many investors wondering how best to get a piece of the action now. The answer, experts say, is

Financial Advisors Who Say…What?

Six financial planners, including Larry Heller, wrote “Creating Prosperity,” about understanding goals. Money isn’t everything. We know that seems like the type of thing a

Our blog

How Much Cash Should You Have in Retirement?

One of the most common and anxiety-inducing questions retirees face is deceptively simple: How much cash should I keep on hand? It might sound like

The 6 Retirement Mistakes To Avoid

Retirement should be a time to enjoy the freedom you’ve worked hard to achieve. But without a well-thought-out plan, it can also bring unexpected stress,

Your 5-Year Retirement Countdown: Key Steps to Take Now

What You Need to Do 5 Years Out From Your Retirement As retirement approaches, it’s natural to feel a mix of excitement and unease. Stepping

5 Tax Gotchas That High-Net-Worth Individuals Overlook

As retirement approaches, one of the most important aspects of helping secure your financial future is understanding the intricacies of tax planning. For high-net-worth individuals,

Retirement Unlocked: Managing Sequence of Returns Risk

Understanding Sequence of Returns Risk in Retirement Planning Retirement planning can often feel like walking through a financial minefield. One of the most important, yet

Mastering Retirement Withdrawals: Essential Strategies for a Smart Distribution Plan

Retirement is often seen as the reward for decades of hard work, but without careful planning, it can quickly become a source of financial stress.

Why You Shouldn’t Rely on Market Experts for Predictions

Every year, as January rolls in, financial analysts and market experts flood media outlets with bold predictions for where the market is headed. From the

Avoid These 7 Financial Planning Mistakes

Financial planning isn’t just about crunching numbers; it’s about making smart decisions that protect your future and give you peace of mind today. Think of

Making Your Retirement Wealth Last: 5 Essential Strategies for a Well-Planned Future

Retirement is more than a finish line—it’s the start of a new chapter that requires a shift in focus from growing wealth to making it

The Hidden Risks of Handshake Deals: Why Your Business Needs Formal Agreements [Ep. 163]

The Hidden Risks of Handshake Deals: Why Your Business Needs Formal Agreements [Ep. 163] In this episode of Life Unlimited, Larry Heller, CFP®, CDFA®, sits

How to Thrive Amid Interest Rate Changes [Ep. 162]

How to Thrive Amid Interest Rate Changes [Ep. 162] In this episode of Life Unlimited, Larry explores how changing interest rates can directly impact your

Avoiding Retirement Disasters: Six Common Pitfalls [Ep. 160]

Avoiding Retirement Disasters: Six Common Pitfalls [Ep. 160] In our latest episode, Larry discusses the six major pitfalls that can derail your retirement plans and

New Laws, New Opportunities: Secure Act 2.0 Changes to 529 Plans

New Laws, New Opportunities: Secure Act 2.0 Changes to 529 Plans In this episode, we explore the recent changes to 529 plans, allowing for a

How Heller Wealth Management Empowers Business Owners: A Deep Dive

How Heller Wealth Management Empowers Business Owners: A Deep Dive Welcome to the Life Unlimited Podcast Hosted by Larry Heller, the Life Unlimited Podcast is

From Investments to Planning: A Deep Dive Into Our Services

From Investments to Planning: A Deep Dive Into Our Services Effective financial planning extends beyond mere investment decisions; it’s about creating a comprehensive strategy that

Navigating Taxes in Investing: What You Need to Know to Optimize Your Retirement

Navigating Taxes in Investing: What You Need to Know to Optimize Your Retirement Unlocking Tax Advantages with Strategic Planning Strategic tax planning plays a pivotal

Decoding Private Credit: A Golden Age for Investors

Decoding Private Credit: A Golden Age for Investors Private credit is a financial asset class that has been gaining popularity over the past few years,

An Employer’s Guide to 401k Plans: A Four-Part Series (Part IV)

An Employer’s Guide to 401k Plans: A Four-Part Series (Part IV) Empowering Employees: The Far-Reaching Impact of 401(k) Plans Fostering Employee Wellness and Engagement with

The Great Wealth Transfer, Part 2: Bridging Generations (Ep. 142)

The Great Wealth Transfer, Part 2: Bridging Generations (Ep. 142) As we dive deeper into the phenomenon of The Great Wealth Transfer, Part 2 of

The Great Wealth Transfer, Part 1: From Boomers to Millennials (Ep. 141)

The Great Wealth Transfer, Part 1: From Boomers to Millennials (Ep. 141) The Great Wealth Transfer isn’t just a catchphrase; it’s a seismic shift poised

Maximizing Annual Savings in Retirement Plans: Smart Strategies for a Secure Future

Planning for retirement requires more than just setting aside a portion of your income. It’s about making the most of the financial tools available to

Building Financial Resilience: A Closer Look at Financial Planning with Heller Wealth Management

Building Financial Resilience: A Closer Look at Financial Planning with Heller Wealth Management In an ever-changing financial landscape, the importance of financial resilience cannot be

Retirement Reality Check: Are You Spending Enough? (ep.136)

How Much Can You Spend in Retirement? Recently Larry sat down with Matt Halloran to record an episode of Life Unlimited. During their discussion, they

When Poor Customer Service Leaves a Bad Taste in Your Mouth (Ep. 135)

Our journey home began with thunderstorms in New York, leading to our flight being canceled. We found ourselves in long lines, trying to rebook our

Navigating Loss: 4 Essential Steps to Take as the Surviving Spouse (Ep. 132)

Navigating Loss: 4 Essential Steps to Take as the Surviving Spouse (Ep. 132) Losing a spouse is a challenging and emotionally overwhelming experience. Amidst the

The Risk Factor: Unraveling Investment Pitfalls

The Risk Factor: Unraveling Investment Pitfalls In the dynamic world of finance, the significance of risk assessment cannot be overstated. Failing to assess risks adequately,

Ready, Set, Retire: Key Steps for Securing Your Financial Future

Ready, Set, Retire: Key Steps for Securing Your Financial Future When planning out your retirement, it is helpful to understand each element like a puzzle

RMDs & The Age Increase: What This Means For Your Portfolio

RMDs & The Age Increase: What This Means For Your Portfolio With the emergence of the new SECURE (Setting Every Community Up For Retirement Enhancement)

QDRO & Divorce: Understanding Legal Practices

QDRO & Divorce: Understanding Legal Practices A QDRO (Qualified Domestic Relations Order) is a legal document that is brought forward during the settlement of a

Using a Cash Balance Plan to Save Large Pre-Tax Dollars

Using a Cash Balance Plan to Save Large Pre-Tax Dollars Let’s start with the basics: A cash balance plan is a defined benefit plan. It’s

Investing with the Reservoir Strategy (Ep. 119)

Investing with the Reservoir Strategy (Ep. 119) When investing with a financial advisor, there are a number of steps to follow that are important to

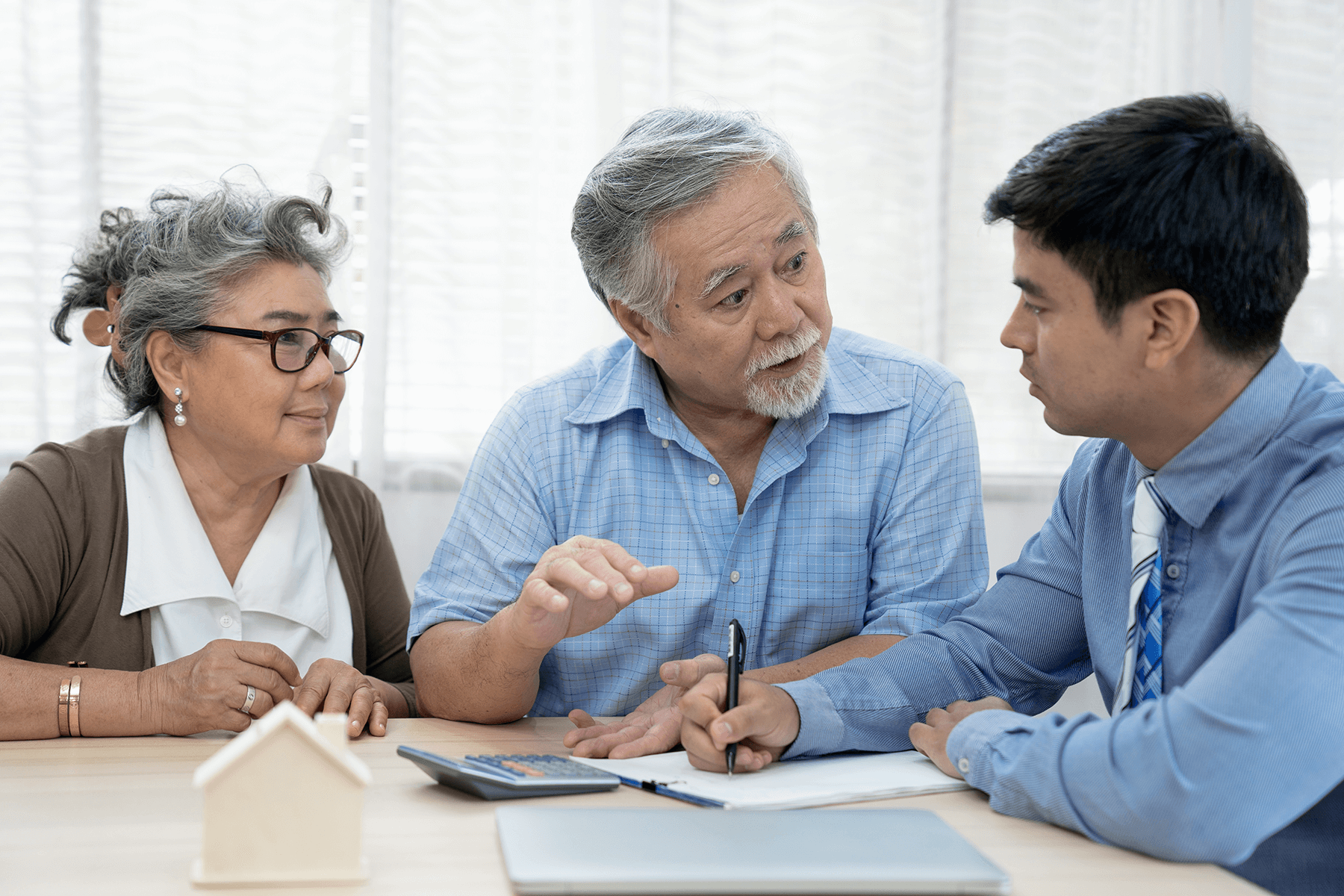

Time to Have Those Tough Conversations with Your Parents (Ep.117)

Time to Have Those Tough Conversations with Your Parents (Ep.117) Calling all members of the sandwich generation! If you’re in your 30’s or 40’s, have

Tending Your Investment Strategy with Tax Loss Harvesting

Tending Your Investment Strategy with Tax Loss Harvesting Let’s start with the basics… What are short term capital gains? Short term capital gains are assets

What You Need To Know About Retiring in a Recession

What You Need To Know About Retiring in a Recession No matter what job you have or how well you have prepared for retirement, inflation

Navigating A Bear Market As A Soon-To-Be Retiree

Navigating A Bear Market As A Soon-To-Be Retiree You’ve done it. You’ve invested, saved, and properly allocated your money to live a fulfilling retirement…but now

Common Errors To Avoid When Passing Money To Your Heirs Upon Death

Common Errors To Avoid When Passing Money To Your Heirs Upon Death Organizing your financial documents should never be a rushed process. These documents can

Taking Financial Responsibility Before You’re a Widow or Widower

Taking Financial Responsibility Before You’re a Widow or Widower Although planning for you or your spouse’s passing is not anywhere near a fun thing to

Combating Inflation’s Effect on Your Retirement Plan

Combating Inflation’s Effect on Your Retirement Plan No matter who you are or what stage of life you are in, you experience the effects of

How Getting Divorced After Age 50 impacts Retirement Planning

How Getting Divorced After Age 50 impacts Retirement Planning Getting divorced later in life can be more complicated than you may anticipate. Have you considered

10 Things to Do Within 10 Years of Retirement

10 Things to Do Within 10 Years of Retirement By Belinda Tsui, AIF, CFP® You’re in the final stretch and heading towards the finish line.

What to Expect When Working with Heller Wealth Management

What to Expect When Working with Heller Wealth Management Planning for your future includes so much more than just investment management. “A lot of people,

In an ETF/Mutual fund and think you’re diversified? Better double check

In an ETF/Mutual fund and think you’re diversified? Better double check When talking about investing, we always hear the buzzword “diversification”. It is commonly said

100th Episode: Life Unlimited (formerly known as Retire Right)

100th Episode: Life Unlimited (formerly known as Retire Right) “We hit 100 and we’re not stopping!” – Larry Heller CFP® Larry has reached his 100th

5 Important Planning Steps to Take Before Retiring

5 Important Planning Steps to Take Before Retiring As you start to consider retirement, there are five extremely important planning steps to take before your

3 Estate Planning Tips to Consider When Creating Your 2022 Cash Flow Game Plan

There’s a lot to consider when it comes to estate planning in the new year — especially when it comes to tax deductions.

3 Estate Planning Mistakes You’ll Want to Avoid if You’re a Divorcee

There’s a lot to consider when it comes to estate planning — especially if you are a divorcee; here are estate planning mistakes to avoid.

Don’t Be a Victim of Identity Theft This Holiday Season. Protect Your Little Ones As Well. – By Belinda Tsui AIF®, CFP®

Don’t Be a Victim of Identity Theft This Holiday Season. Protect Your Little Ones As Well. – By Belinda Tsui AIF®, CFP® You’ve made your

Tulips, Cannabis, Crypto, NFTs…What’s Next? – By Greg Moss, CFP®

Tulips, Cannabis, Crypto, NFTs…What’s Next? Have you heard of Tulipmania? It was a period of time in 17th century Holland when tulip bulbs (a luxury

3 Strategies to Save Income Taxes on Your Investments

Taxes: Nobody likes them. But most people want to make an investment regardless of the taxes they will have to pay on them. However, there

Do I have enough money to retire? Here’s how much cash retirees really need, according to financial advisors

Have you ever asked yourself “Do I have enough money to retire?” With rock-bottom interest rates and fears of inflation, retirees may worry about their