Investing with the Reservoir Strategy (Ep. 119)

When investing with a financial advisor, there are a number of steps to follow that are important to make sure your investment strategy works for you and your family, creating the lifestyle you desire. In the discovery phase, we shed light on the important questions that can identify everything from your ideal retirement to what your risk tolerance is, especially when choosing to invest with a partner who has different views than yourself.

In the table below you can see where we likely want our clients to be placed when it comes to growth asset investments. This is due to the level of gains you will be able to achieve through working through a higher level of risk. Without a little bit of risk, your returns might not be as high as you expect as the comfortable decision is not always the best one.

In the table below, as you can see, the green area is where clients are the most comfortable. This is an area that provides the least amount of risk and allows for a comfortable investment strategy that does not need to necessarily take into account the current state of the market. The yellow is marginal, where some clients might be uncomfortable and uneasy with some decisions while the red area is the two extremes of complete risk in which clients might feel nervous about the future of their portfolio. As you can see there are two bars that are one in the same and this is because we like to touch on this when married couples are deciding to invest together. As you know, there is always one partner who is on the safer, more comfortable side while the other is willing to take more risk and has less fear of loss. Sometimes when we do this for each spouse, they are in alignment but when they are off, it is important to meet in the middle and make decisions that both will feel confident in.

Risk aside, we find importance in truly understanding your positioning and where you see your life down the line. This means asking important questions such as how much money do you want to have available in your retirement years? How much property do you want to own? Do you have any big expenses such as a wedding or home purchase that can take a chunk out of your income? Or say maybe you are already nearing or in your retirement, if you need to make a large purchase, how much of your income will you be able to pull out of your portfolio safely without disrupting your long term plan?

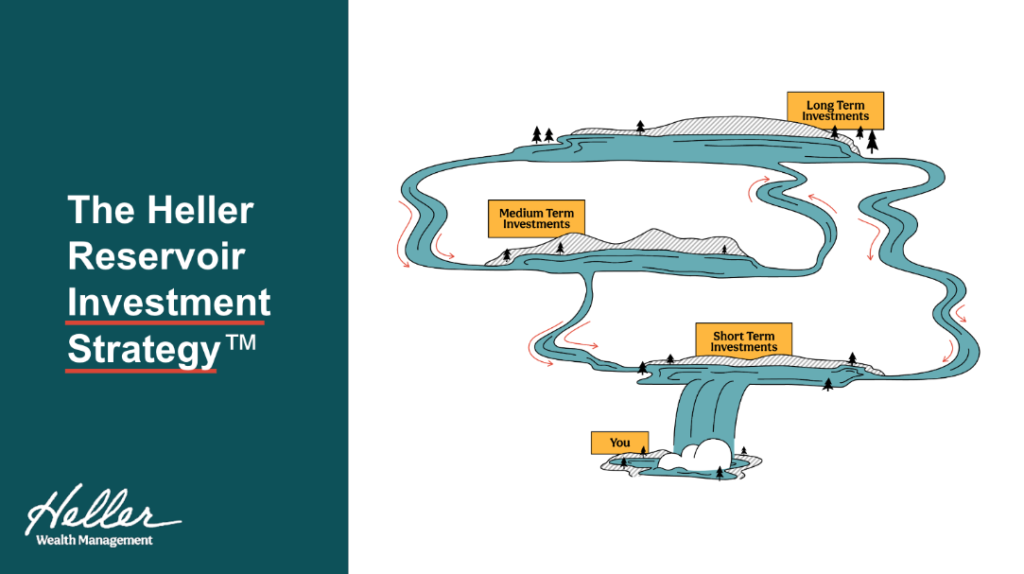

After understanding where both spouses stand in terms of risk and while we have identified all the necessary information necessary to create a portfolio based on the trajectory of your retirement, we can go into the reservoir strategy and how we invest with that. Now, the reservoir strategy, unlike many other investment strategies, is used both when the markets are up and down, due to the long term understanding and processes that make it work.

In the image above, you can see how we view the reservoir investment strategy and how it can work for you.

The main idea is to spread out your income and investments in each main area of the map (long term, medium term and short term) so that the river keeps flowing, while not placing too much in one area causing the rest to dry up. Starting with the long term investments, dividends and interest can flow from there to the medium term investments all the way to the short, in order to replenish that reservoir. The important thing to understand is that you need to start at the long term investments, placing the majority of your savings in there in order to take money out as you go to replenish the other two areas that are not as vital for long term growth. As you can see, this strategy makes sure that income is always flowing from one place to another, depending on where your needs are at your current stage of life.

After going through this understanding, we find it very important to check in with our clients every 5 or so years to make sure that they are on the right track. Whether that means they are getting closer to their portfolio goals or they are simply taking advantage of the investments they have gained through our strategy, we want to make sure that nothing big has changed. Now in the case where clients come to us and say they have a number of new dependables such as a new child in the family, a new property getting purchased or simply a lifestyle change that might require more money being taken out each month, we will then go back to the drawing board and restructure this strategy to work for your new and improved lifestyle.

Click to listen to Investing with the Reservoir Strategy (Ep.119) on the Life Unlimited podcast!