Say hello to

taking care of business.

Ready to elevate your 401(k) experience?

Make the smart choice for your company’s 401(k) management. Partner with Heller Wealth Management and experience the difference that expertise, customization, and dedicated support can make.

Why Choose Heller Wealth Management for Your 401(k) Needs?

- Expertise Tailored to You:

- Our team brings a wealth of knowledge and experience in navigating the intricacies of 401(k) management for small to mid-sized businesses. We don’t just understand the industry; we understand your unique needs.

- Customized Solutions:

- No two businesses are alike, and neither should their retirement plans be. Our 401(k) solutions are meticulously crafted to fit the specific requirements of companies with 2-99 employees. From plan design to implementation, we tailor every aspect to align with your company’s culture and goals.

- Cost-Effective Excellence:

- We know that managing costs is crucial for businesses of this size. Our plans are not only competitive but also designed to be cost-effective, ensuring that you can provide robust retirement benefits without breaking the bank.

- Dedicated Support:

- At Heller Wealth Management we believe in building lasting partnerships. Our team is committed to providing unparalleled support, guiding you through every step of the process. From initial setup to ongoing administration, we are here to ensure a seamless experience.

- Elevate Employee Well-being:

- A well-crafted 401(k) plan is not just about compliance; it’s about the financial well-being of your employees. Our specialized solutions aim to enhance the retirement benefits offered, contributing to a happier, more secure workforce.

Make the smart choice for your company’s 401(k) management. Partner with Heller Wealth Management and experience the difference that expertise, customization, and dedicated support can make.

Corporate Retirement Plans

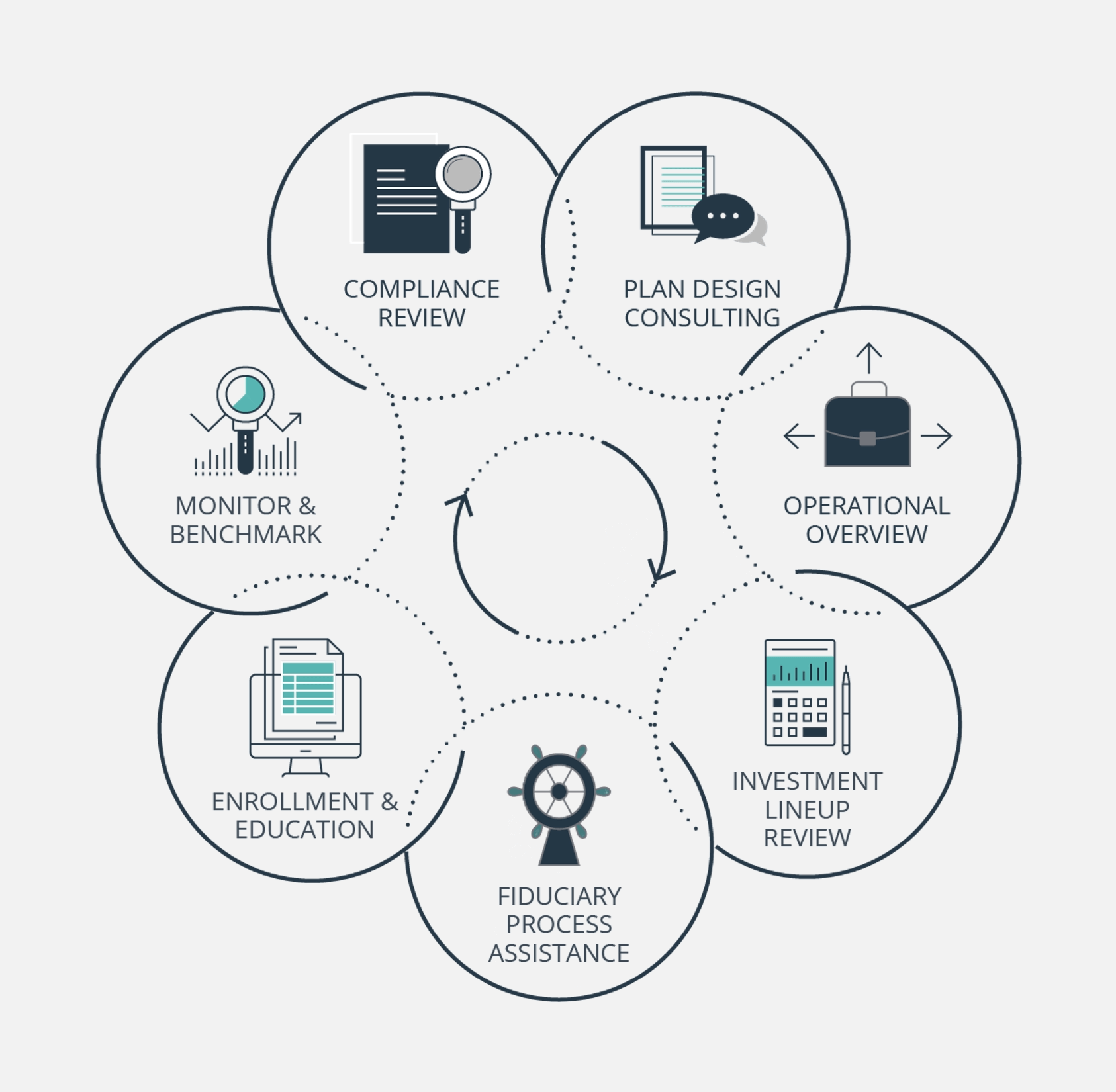

As your Retirement Plan Partner, we oversee and coordinate all aspects of building a world-class 401(k) experience for your company.

- Design & implementation – creating and managing a 401(k) that works for you.

- Governance & compliance – fully transparent fiduciary oversight.

- Active management & monitoring – ensuring the investment mix is right and resilient.

- Plan participant education – informing and advising employees and plan administrators.

What is your Fiduciary Score? Take our quiz to find out!

Plan Sponsor Support

Plan Sponsor Support

- Plan Design

- Investment Policy Statement (IPS)

- Periodically conduct an internal benchmark review

- Keep informed on Law Changes

Employee Education

Employee Education

- Annual Education Workshops

- Online Tools & Retirement Calculators

- Email Newsletter Program

- Online Personalized Retirement Projections

Investments

Investments

- 3(38) Fiduciary

- Open Architecture/Transparent Fees

- Risk Based Model Portfolios

- Auto Rebalance Options

Service Team

Service Team

- Dedicated Point of Contact

- Coordinated Communication

- Recordkeeping with enhanced technology

- Annual Review Meetings with Plan Sponsor