Say hello to

free to be

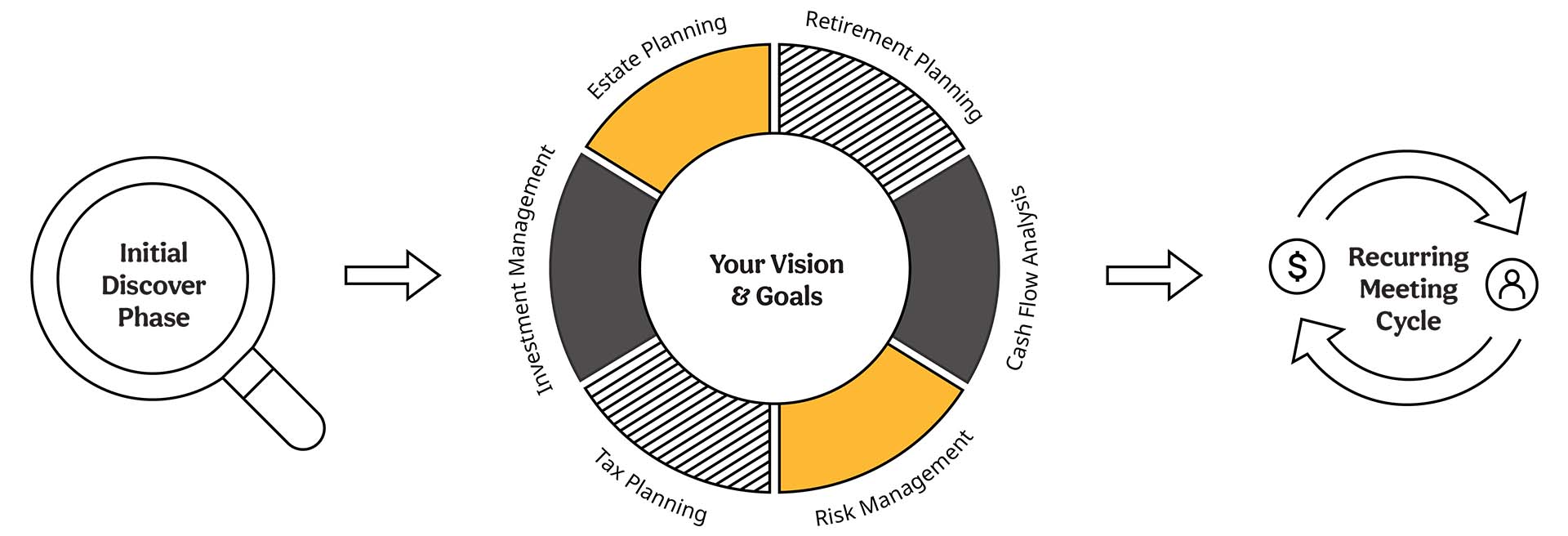

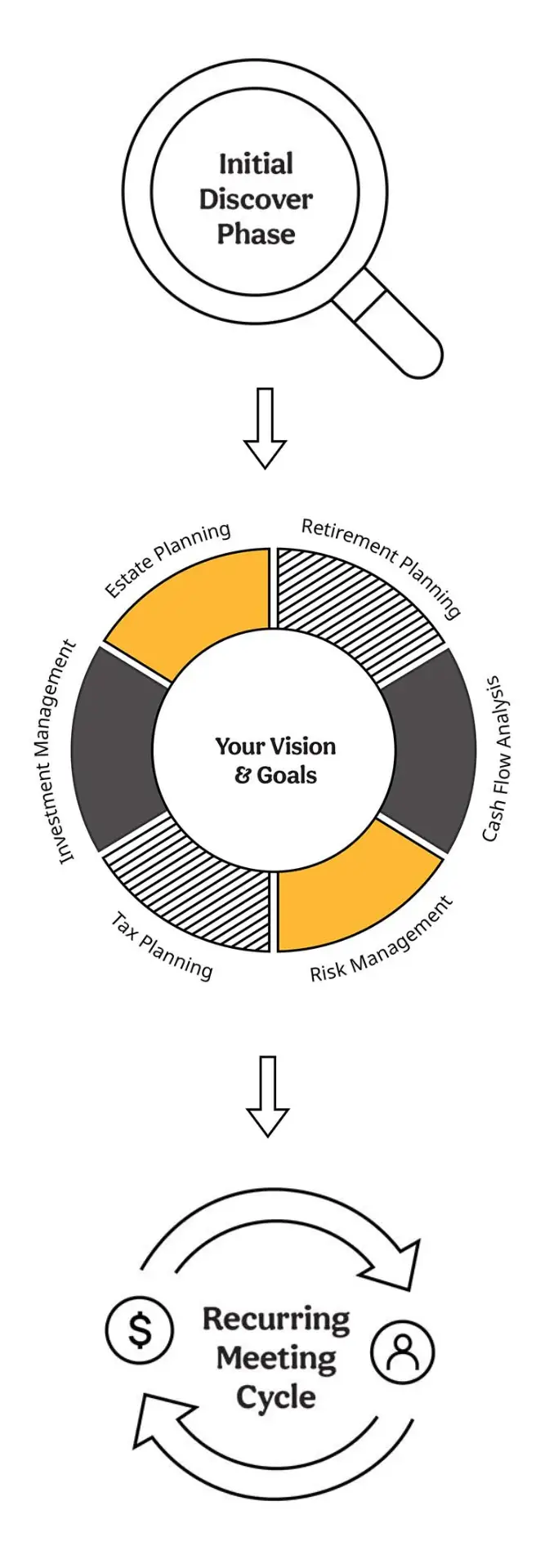

Our Approach

A Strategy Tailored to Your Life and Goals

Discovery

Uncover your lifetime aspirations and financial goals through comprehensive conversations that explore every detail of your financial life. Our Discovery process aims to fully understand your current situation, prioritize your objectives, and align with your future ambition

Analyze and Implement

Analyze and Implement Using our proprietary process, we objectively analyze asset mixes to optimize value, growth, and resilience. The goal is a tailored financial plan aligned with your vision and priorities, factoring in your goals, risk tolerance, and time horizons.

Evolve

Life is unpredictable, so we prioritize financial resilience. We continuously monitor your situation, meet regularly to refine strategies, and provide ongoing updates and recommendations as your life evolves.